The World Bank, through its lead arm, the International Bank for Reconstruction and Development (IBRD), has issued a 9-year bond worth US$225 million. This bond supports carbon removal by financing reforestation in the Brazilian Amazon rainforest.

Exploring the world bank Carbon removal bond

Jorge Familiar, Vice President and Treasurer of the World Bank, noted:

“A A variety of partners and financing instruments are needed to support the Amazon and help its people to improve their living conditions, protect its incredible biodiversity and secure its global role in mitigating climate change..”

This is especially the largest World Bank bond directly linked to reforestation efforts in the Amazon region, promising fantastic returns. As mentioned in the press release, investors will receive a return through a fixed coupon and a variable component tied to Carbon Removal Units (CRUs). In addition, the reforestation projects in Brazil will generate these credits.

In addition, investors welcome this bond as unique because it links its financial returns to actual CO2 removal, unlike previous bonds that are tied to the sale of emission allowances from emissions avoidance.

The most important thing about this bond is that $36 million will go to the Brazilian company Mombak. Mombak will use the funds to reforest land in the Amazon with native trees, promote biodiversity and support local communities. This bond presents an innovative approach to mobilizing private capital to finance reforestation.

Their emission rights boost global markets

Last year, the World Bank unveiled its plans to expand highly integrated global carbon markets to help 15 countries generate income by protecting their forests. Participating countries included Chile, Costa Rica, Ghana and Indonesia. The bank expects these countries to generate over 24 million carbon credits. in one yearand could potentially generate up to $2.5 billion by 2028.

The initiative is led by the World bank Forest Carbon Partnership Facility (FCPF) with a focus on environmental and social integrity. Since 2018, the FCPF has pioneered the development of carbon credit systems, ensuring that credits are clear, measurable and permanent. These credits are strictly monitored by third parties and verified based on World Bank standards.

Can this bond deliver high returns and save the Amazon rainforest?

Jorge Familiar has been closely following this historic transaction. He believes it demonstrates the eagerness of private investors to link their financial returns to positive results. In The Amazon. In addition, the promising returns signal increasing interest in this structure and the growth of the supported sectors.

Essentially, The binding is 100% protected and guaranteed Investors Money is safe. The $225 million raised will be used to finance the World bank global efforts towards sustainable development. Instead of full regular interest payments, investors will receive part of the support Restaurant Mombaks Reforestation projects through a contract with its hedge partner HSBC. In addition, these projects are in line with the World bank Destinations in the Amazon, but are not financed through IBRD loans.

The Carbon removal units The CRUs generated by these projects are soldAnd Part of the proceeds will be paid out to bondholders as CRU Related Interest. In addition, investors receive a guaranteed minimum interest rate. If The projects are successful as expectedbondholders could earn more compared to similar World Bank bonds.

Greg Guyett, CEO of Global Banking & Markets, HSBC commented,

“WWe are pleased to work with the World Bank on this innovative bond which aims to support the reforestation of thousands of hectares of the Brazilian Amazon rainforest. We are committed to helping our clients finance sustainable development projects that make a difference to the climate challenge. It was a privilege for HSBC to structure the transaction and act as sole lead manager for the World bank the largest profit bond issue to date.”

strengthening Investors Trust

Well-known investment partners include Mackenzie Investments, T Rowe Price, Nuveen, Rathbone Ethical Bond Fund and Velliv.

Investors believe this bond has the potential to deliver attractive financial returns with measurable positive impacts. They expect significant benefits through carbon removal, biodiversity enhancement and job creation.

Hadiza Djataou, Vice President, Portfolio Manager, Fixed Income, Mackenzie Investments has clearly noticed

“TThis transaction in partnership with Mombak provides a groundbreaking opportunity for nature-friendly investments while supporting land management principles. We believe that the bond The unique structure will prove to be both a strong investment and a catalyst for further innovation in the sustainable bond market.“

Deciphering the world bank Interest in Brazil

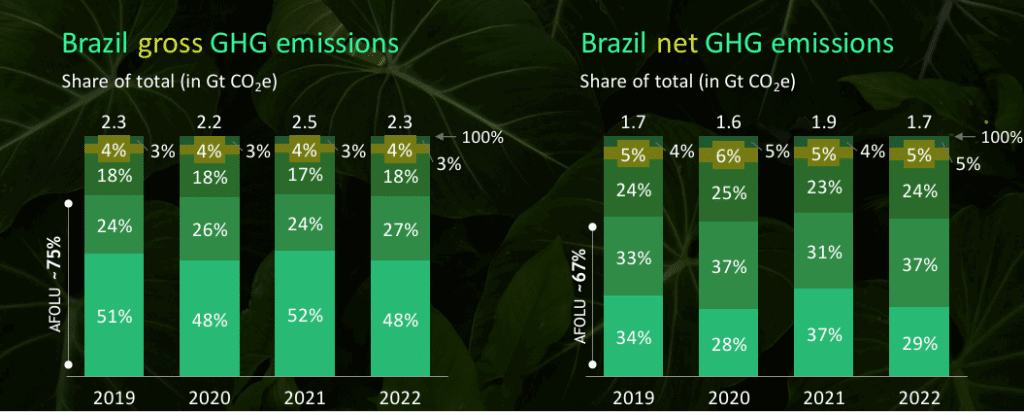

Greenhouse gas emissions in Brazil exceeded 2.3 billion MtCO₂e in 2022, a decrease of over 8% in comparison compared to the previous year. The country climate-friendly investments are expected By 2050, the total is expected to be 2 to 3 trillion dollars. Brazil’s the latest climate report predicted this.

Source: Brazil 2024 Climate Report

Source: Brazil 2024 Climate Report

Interestingly, AP News revealed that in 2022, trees in the Amazon contained 56.8 billion MtCO₂e, making the Amazon a gigantic Carbon sink. However, climate experts warn of ongoing deforestation, which could transform the Amazon from a carbon sink into a carbon source. The is one of the reasons why Brazil has become a hotspot for environmental protection activities, especially in the Amazon rainforest.

Speaking of Brazil, the world bank Connection with the country is not something new. In 2022, it analyzed how Brazil could achieve its climate goals and supported innovative projects. This included a climate finance solution worth a whopping US$500 million. This initiative aimed to expand sustainability-related financing and facilitate private sector access to the carbon credit market.

The World Bank announced the Amazon Reforestation Bond on June 14. They initially left the exact capital amount open, but have now confirmed it.