Wolverine World Wide, Inc. (NYSE:WWW) will pay a dividend of $0.10 on November 1. The dividend yield on this basis is 3.2%, which is still above the industry average.

Check out our latest analysis for Wolverine World Wide

Wolverine World Wide’s payment shows solid revenue coverage

While an impressive dividend yield is good, that doesn’t matter so much if the payments can’t be sustained. Even though Wolverine World Wide doesn’t make a profit, it generates healthy free cash flow that easily covers the dividend. We generally believe that cash flow is more important than accounting profit metrics, so we’re quite happy with the dividend at this level.

According to analysts, earnings per share should be several times higher next year. If the dividend follows recent trends, we estimate the payout ratio to be 9.6%, so the pressure on the dividend is not too great.

Wolverine World Wide has a solid track record

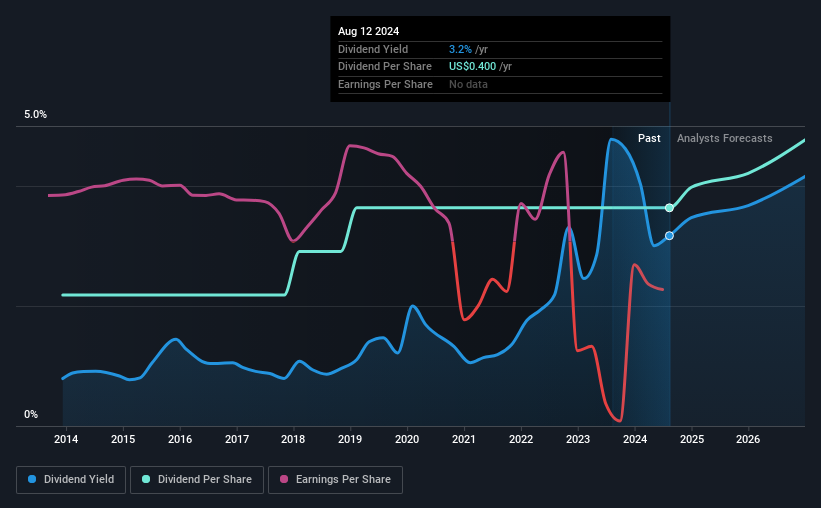

The company has a long history of paying dividends and these have been relatively stable, giving us confidence in its future dividend potential. The annual payment over the last 10 years was $0.24 in 2014 and the payment in the last fiscal year was $0.40. This represents a compound annual growth rate (CAGR) of approximately 5.2% per year over that period. Dividends have grown at a reasonable rate over that period and without any major cuts in payments over time, we think this is an attractive combination as it significantly enhances shareholder returns.

The dividend has limited growth potential

Investors who have held shares in the company over the past few years will be pleased with the dividend income they have received. However, first impressions may be deceptive. Wolverine World Wide’s earnings per share have shrunk 45% annually over the past five years. A sharp decline in earnings per share is not good from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. On the positive side, earnings are expected to gain a bit next year, but until this proves to be a pattern, we wouldn’t get too comfortable.

In summary

Overall, it’s nice to see a consistent dividend payment, but we think the current payout level may not be sustainable in the long term. The company generates a lot of money, but we still think the dividend is a little too high to be satisfied with. This company is not in the top tier of income-producing stocks.

Companies with a stable dividend policy are likely to attract more interest from investors than those with a more inconsistent approach. However, investors must consider a number of other factors besides dividend payments when analyzing a company. Just as an example: We are on 2 warning signs for Wolverine World Wide You should be aware of this, and 1 of them is concerning. Is Wolverine World Wide not quite the opportunity you have been looking for? Why not check out our Selection of the highest dividend stocks.

Valuation is complex, but we are here to simplify it.

Find out if Wolverine World Wide could be undervalued or overvalued with our detailed analysis, including Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.