The news that Warren Buffett’s Berkshire-Hathaway sold 389 million of its Apple Stocks sent shockwaves through the stock market. While one could argue that Buffett’s Apple stake is still too large relative to Berkshire’s overall portfolio, it was a remarkable move by any measure.

The stock sale leaves Berkshire with more than $271 billion in cash. In making the move, Buffett’s team introduced some new positions. It also invested significant funds in short-term bonds, where they could remain for the foreseeable future. However, the company is still open to more lucrative investments than Apple, and these artificial intelligence (AI) stocks could provide higher returns.

Does anyone suffer from Monday blues?

Jake Lerch (Monday.com): Let’s start with the basics – what Monday.com (NASDAQ: MND) does.

In In briefMonday.com provides organizations with cloud-based workflow management tools. The systems can be customized to integrate proprietary applications and leverage generative AI to increase operational efficiency. In addition, the platform’s ease of use is a key selling point. The system operates on a “no-code/low-code” principle, requiring little technical expertise to create time-saving workflows.

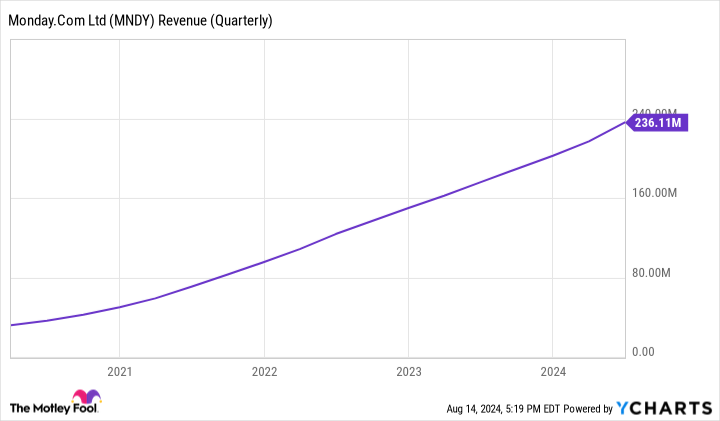

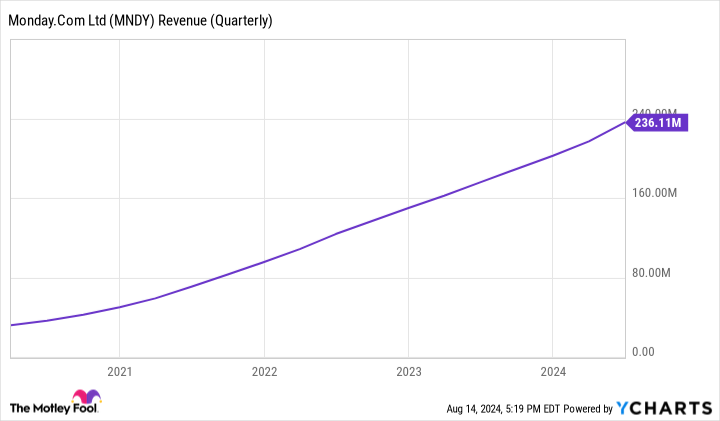

Thanks to the popularity of its platform Monday.com attracts customers and business flourishes. Almost all of Monday.com’s revenue comes from subscriptions – a more stable and predictable source of income than one-time sales.

In its most recent quarter (ending June 30, 2024), Monday.com reported revenue of $236 million, up 34% year over year. In addition, revenue from large accounts (those paying more than $50,000 in annual recurring revenue) increased 43% year over year. Finally, and perhaps most importantly, the company has a Key Threshold for each growth stock: GAAP profitability.

Chief Financial Officer of Monday.com Eliran Glazier summed up the quarter as follows: “Most notably, we achieved exceptional efficiency in the second quarter and GAAP operating profitability in the first quarter. These results demonstrate not only our highly effective execution, but also the strong demand we continue to see even in a difficult macroeconomic environment.”

Admittedly, like all growth stocks, Monday.com comes with certain risks. The company has had a profitable quarter — but it was a very a meager profit of just $1.8 million. As the company continues to focus on increasing sales, it is possible that profit will take a back seat. In addition, an economic downturn could — or a recession — would be bad news for the company.

For many investors, Monday.com is still worth considering due to its rapidly growing customer base, rapid revenue growth and new profitability.

A fast-growing, financially strong company at a stunningly low price

Justin Pope (SentinelOne): SentinelOne (NYSE:S) is a rising star in the cybersecurity space. The stock gained momentum after CrowdStrikeuntil recently, volatility in small and mid-cap stocks pushed shares back down from $30 to below $20. But the stock’s gains were no fluke; SentinelOne is an attractive long-term investment for shareholders looking for growth at a bargain price. Let’s take a closer look.

SentinelOne delivers cybersecurity solutions through its Singularity platform, using artificial intelligence (AI) instead of human agents to identify and combat potential threats. The result is proactive, autonomous security that is among the best products on the market. SentinelOne consistently receives high scores in third-party reviews and has an average rating of 4.7 out of five stars on Gardener‘s Peer Insights, which tracks feedback from verified users. SentinelOne boasts rapid growth momentum, including 39.7% year-over-year revenue growth in the most recent quarter.

The company’s ability to launch and sell new products is impressive. SentinelOne recently launched a data lake product and AI Purple, a generative AI that assists users in security operations. New products contributed 40% of new orders in SentinelOne’s most recent quarter, including an over 100% increase in data lake sales.

Growth is great, but SentinelOne has not been making profits, which is a valid criticism and probably the reason why the stock has declined in recent years. But the company is also making tremendous gains here. The company’s free cash flow margin turned positive last quarter, rising to 18% of revenue. The company is well financed, with $773 million in cash and zero debt. Investors should not worry about SentinelOne’s sustainability, even in a potential recession.

The stock’s cheap valuation rounds out the investment case. SentinelOne has lagged behind its cybersecurity peers, including CrowdStrike. CrowdStrike’s current valuation, an enterprise value to sales ratio of 15, beats SentinelOne’s ratio of under 8, even after CrowdStrike’s recent black eye. SentinelOne’s valuation could stay where it is, and given the company’s rapid growth and rising profitability, investors will still benefit.

SentinelOne seems to be a sure-fire winner in a market currently lacking in bargains.

Despite massive gains, this hardware stock is a huge bargain

Will Healy (Super Microcomputer): One of the most notable AI stocks of recent years is Super-microcomputer (NASDAQ:SMCI)The maker of servers and other hardware spent most of its 30-year history in obscurity, with few outside the industry knowing the company.

Although it went public in 2007, the stock only really took off during the pandemic, when the sudden need to move to the cloud fueled demand for its servers. However, the key to the massive rise in the stock was its partnership with NVIDIA and placing the company’s AI chips in its servers. These industry trends have led to share price gains of around 3,500% over the past five years and a 1:10 stock split is imminent.

But what should catch the attention of Buffett and other bargain hunters is the gain, which was as high as 6,900% at Supermicro’s highest closing price on March 13. This means the stock has lost about 50% of its value over the past five months.

The decline was likely a reaction to the rapid rise in its stock price, especially over the past year. Despite the sell-off, net income rose 89% annually to $1.2 billion in fiscal 2024 (which ended June 30) due to unprecedented demand for its AI servers.

With earnings rising and stock prices falling, the company’s valuation has become reasonable by almost any measure. Although the P/E ratio briefly exceeded 90 in March, the earnings multiple now stands at 30, a level barely above average. S&P500 Win multiplier of 28.

Although the company did not forecast net income for fiscal 2025, analyst consensus estimates call for net income to increase 58%, which is a positive sign for the stock.

Given the rapid but slowing growth rates, investors are unlikely to push the stock back to 90 times earnings. But with earnings growth of over 50%, Supermicro is on track for rising earnings and an increase in profits.

Should you invest $1,000 in Monday.com now?

Before you buy Monday.com stock, consider the following:

The Motley Fool Stock Advisor The analyst team has just published what they believe to be The 10 best stocks for investors to buy now… and Monday.com wasn’t among them. The 10 stocks that made the cut could deliver huge returns in the years to come.

Consider when NVIDIA created this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, You would have $763,374!*

Stock Advisor offers investors an easy-to-understand plan for success, including instructions on how to build a portfolio, regular updates from analysts, and two new stock recommendations per month. The Stock Advisor Service has more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Jake Lerch holds positions in CrowdStrike and Nvidia. Justin Pope holds positions in Monday.com and SentinelOne. Will Healy holds positions in Berkshire Hathaway, CrowdStrike, and Super Micro Computer. The Motley Fool holds positions in and recommends Apple, Berkshire Hathaway, CrowdStrike, Monday.com, and Nvidia. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.

Warren Buffett just sold half of his Apple shares. 3 AI Stocks That Are Probably Better Investments was originally published by The Motley Fool