TPG invested $1.2 billion in real estate in the second quarter, acquiring two Manhattan office buildings to convert into residential space. The company bought 222 Broadway for $150 million in partnership with Jeff Gural’s GFP Real Estate and acquired 101 Franklin Street for more than $100 million. Both properties suffered significant declines in value and were acquired at significant discounts compared to their previous deals.

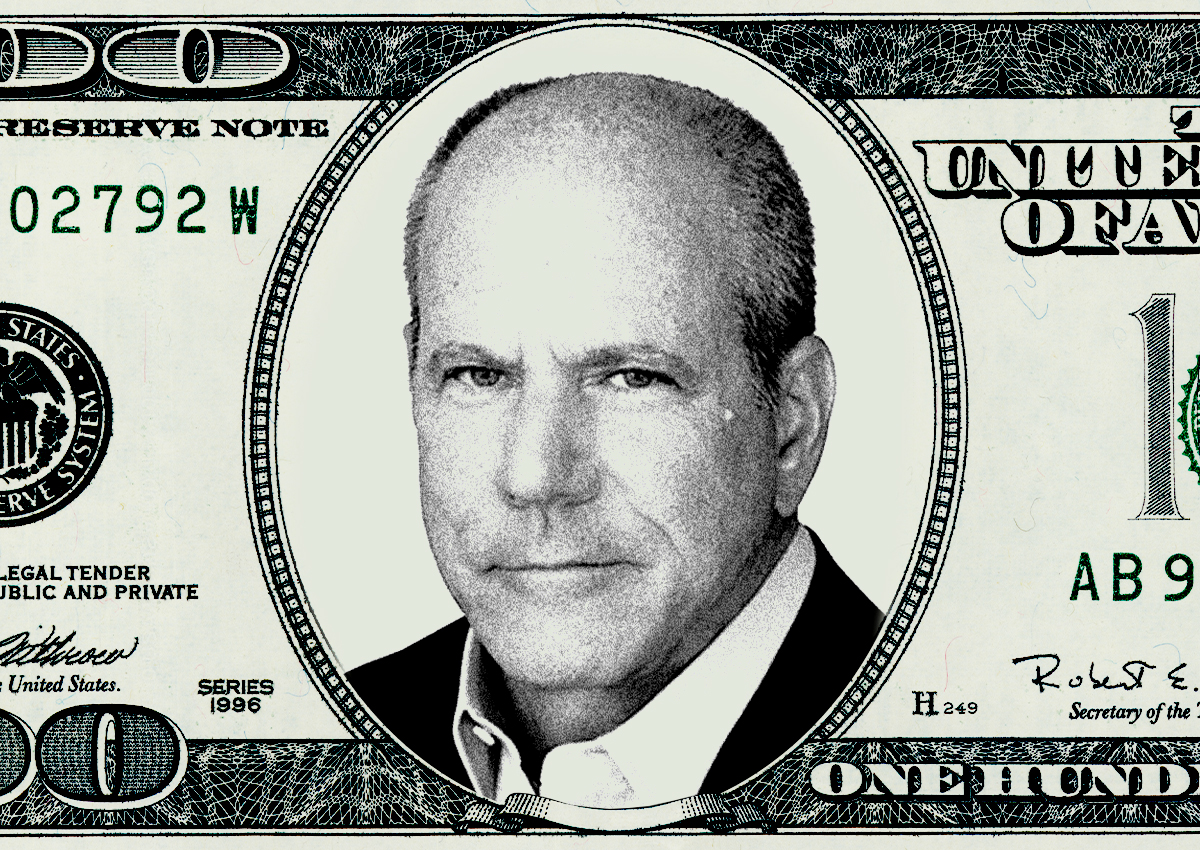

As more properties get into trouble, Winkelried said his company will continue to invest in “high-quality assets” to maximize returns. The company will continue to look for strategic partners as it uses its bulging pockets to invest, he said.

TPG plans to focus on more robust sectors such as student housing and industrial real estate and reduce investments in office space.

The company still has plenty of reserves to use, but Winkelried says TPG will take the same approach it did in the first half of the year after completing its $2.7 billion acquisition of Angelo Gordon late last year.

“We expected that over time, due to the strain on the system, interesting assets would come up for sale,” Winkelried said during the conference call. “And that’s exactly what happened.”

TPG isn’t the only investor looking to move aggressively this year. Crow Holdings has launched a $3.1 billion fund targeting value-added real estate investments across the U.S. The Dallas-based firm, led by CEO Michael Levy, will focus on multifamily, industrial and other sectors. More than 25 percent of the fund has already been deployed.

—Caysey Welton