Old Point Financial Company (NASDAQ:OPOF) will pay a dividend of $0.14 on September 27. Based on this payment, the dividend yield is 2.9%, which is fairly typical for the industry.

While dividend yield is important for income investors, it is also important to consider large price swings, as these generally exceed any gains from distributions. Investors will be pleased to see that Old Point Financial’s share price is up 31% over the past 3 months, which is good for shareholders and may also explain a decline in dividend yield.

Check out our latest analysis for Old Point Financial

Old Point Financial’s dividend should be well covered by earnings

We are not particularly impressed with the dividend yield unless it can be sustained over a longer period of time.

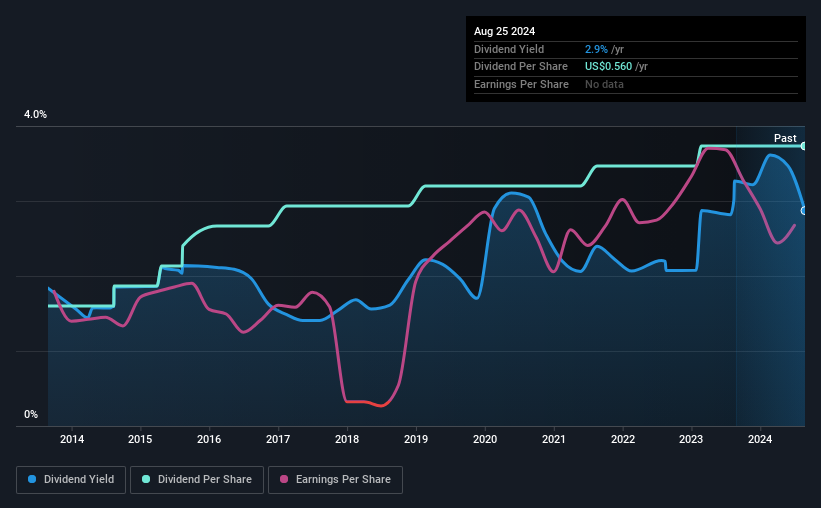

Old Point Financial has paid dividends for at least 10 years, giving it a long history of paying out a portion of its earnings to shareholders. Past payouts are not necessarily a guarantee of future payouts, but the 40% payout ratio is a good sign because it means earnings are adequately covering dividends.

If the trend of the last few years continues, earnings per share could grow by 1.8% next year. Assuming the dividend continues to perform as it has in recent years, we believe the payout ratio next year could be 42%, which is in a fairly sustainable range.

Old Point Financial has a solid track record

The company has a long history of paying dividends with very little fluctuation. Since 2014, the dividend has increased from $0.24 annually to $0.56. This means that the company has increased its payouts by about 8.8% annually during this period. The dividend has grown very well for several years and has provided its shareholders with a nice income in their portfolios.

Old Point Financial may struggle to increase dividend

Investors in the company will be happy to see that it has been receiving dividends for some time. Old Point Financial’s earnings per share have barely changed over the past five years. Even though growth is rather sparse, Old Point Financial could always pay out a higher proportion of its earnings to boost shareholder returns.

We are really excited about Old Point Financial’s dividend

Overall, we would like to see the dividend remain consistent, and we think Old Point Financial could even increase payments in the future. Distributions are fairly easily covered by earnings, which are also converted to cash flow. Taking all of these factors into account, we believe this has solid potential as a dividend stock.

Companies with a stable dividend policy are likely to attract more interest from investors than those with a more inconsistent approach. At the same time, there are other factors that our readers should consider before putting capital into a stock. For example, we have selected the following: 1 warning signal for Old Point Financial investors should know before investing capital in this stock. Looking for more high yield dividend ideas? Try our Collection of strong dividend payers.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.