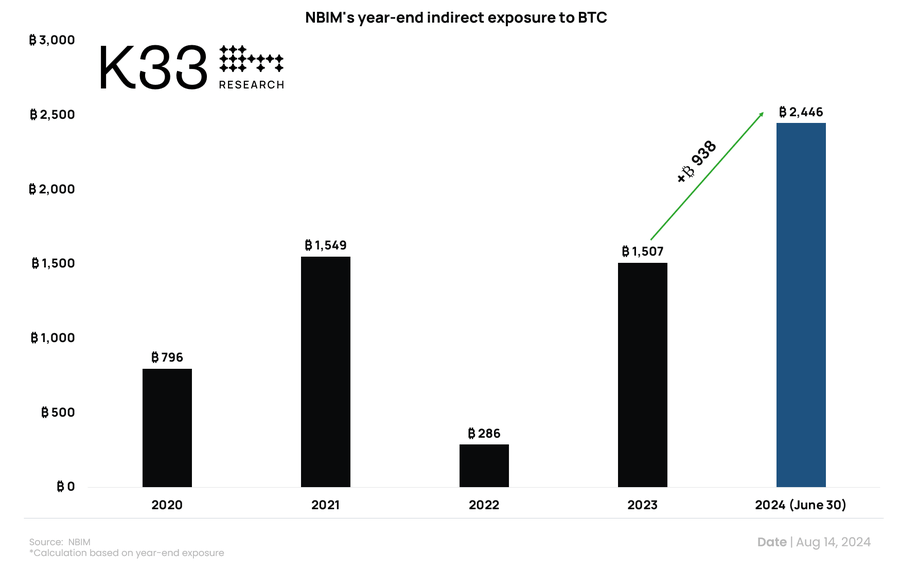

The Norwegian State Pension Fund, commonly known as the Oil Fund, is indirectly invested in Bitcoin, which rose 62% to the equivalent of 2,446 BTC in the first half of this year, according to Vetle Lunde, senior analyst at K33 Research.

This represents an increase of 938 BTC since December 2023, when the company indirectly held the equivalent of 1,507 BTC.

The Norwegian pension fund is the largest sovereign wealth fund in the world, with assets of $1.7 trillion, according to recent reports.

NIBM’s Bitcoin exposure

Lunde attributed this growth to automated sector adjustments and risk diversification rather than a targeted strategy to increase Bitcoin holdings.

He explained:

“(This increase) is likely not due to a conscious decision to accumulate engagement – if the goal was increased BTC exposure, we would see more evidence of direct engagement initiatives (and significantly greater engagement).”

The fund’s Bitcoin exposure, meanwhile, comes from investments in leading Bitcoin-related companies, including MicroStrategy, Marathon Digital, Coinbase and Block Inc.

In the first half of 2024, the fund’s holdings in MicroStrategy increased from 0.67% to 0.89% as MicroStrategy increased its holdings in Bitcoin terms by 37,181 BTC. In addition, the fund increased its holdings in Coinbase from 0.49% to 0.83% and in Block Inc from 1.09% to 1.28%. It also added a 0.82% position in Marathon Digital.

Lunde noted that the fund’s indirect Bitcoin exposure at the end of the first half of the year was 44,476 sats (about $27) per capita.

Investments in other funds

The Norwegian fund’s exposure to Bitcoin is in line with recent trends seen at other pension funds, such as the Wisconsin Pension Fund, which has also increased its exposure to the top cryptocurrency.

Market observers noted that these investments reflect the growing acceptance of BTC as a viable alternative investment. This shift began earlier this year after spot Bitcoin exchange-traded funds (ETF) products were launched in the U.S., making the asset class a viable option for traditional investors.

Lunde explained that these developments show that “Bitcoin is maturing as an asset and will be integrated into any well-diversified portfolio!”