Earnings season is coming to an end, and most S&P 500 companies have already released their quarterly results. And recently we heard from home improvement retailer Home Depot (HD – Free Report) released results that sparked bullish activity.

With our colleague Lowe’s (LOW – Free Report) is about to release its quarterly results on August 20thLet’s take a closer look at what investors can expect.

Home Depot maintains positive outlook

HD beat the Zacks Consensus Estimates for earnings per share by 2.9% and reported revenue that was 1.4% above consensus. Earnings declined slightly from the year-ago period, while revenue increased slightly by 0.6%.

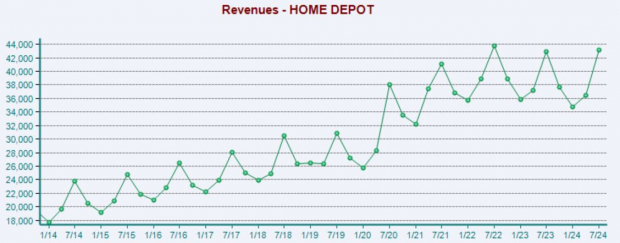

As shown below, the company’s revenue growth has flattened post-pandemic. Advance home improvement demand during the COVID pandemic initially benefited the company significantly, but has reversed as consumers are now tackling far fewer projects.

In other words, consumers were rapidly upgrading their homes (porches, fences) during this period, and this trend has slowed significantly.

Image source: Zacks Investment Research

Ted Decker, CEO, acknowledged the trend but remained positive, stating: “The underlying long-term fundamentals supporting demand for home improvement products are strong.”

He continued: “During the quarter, higher interest rates and greater macroeconomic uncertainty put general pressure on consumer demand, resulting in lower spending on home improvement projects.”

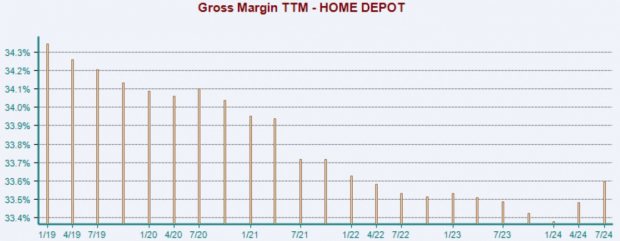

Margin pressure has also had a negative impact on profitability, but recently the tide has turned, as shown below. Please note that the chart is based on the last twelve months.

Image source: Zacks Investment Research

Lowe’s: Growth likely to slow

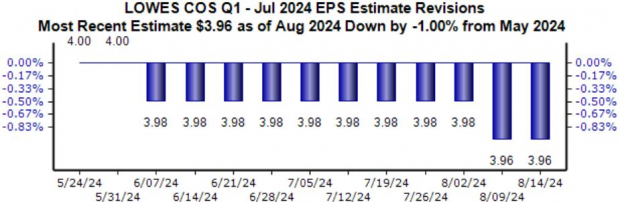

Earnings expectations for LOW have fallen slightly in recent months, but remained stable following HD’s quarterly release, a key development. The company is expected to experience a slowdown in growth, with earnings expected to fall 13% on 4% lower revenues.

Image source: Zacks Investment Research

Similar to HD, Lowe’s is also struggling with a decline in demand. Comparable store sales fell 4% year over year in the most recent period as demand for high-end consumer goods declined. Given HD’s numbers, it’s safe to assume that the company continued to experience a decline in high-end consumer goods throughout the period.

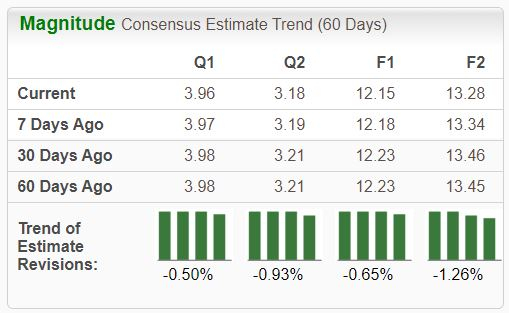

In addition, it is worth noting that LOW is currently a Zacks Rank #4 (Sell) as earnings expectations have generally been heading lower over the past few months. Investors should hold off until positive earnings estimates are revised, which would likely be caused by favorable guidance and better-than-expected quarterly results.

Image source: Zacks Investment Research

Putting it all together

The home improvement giant Home Depot (HD – Free Report) recently released its quarterly results and shares reacted slightly positively after the results were announced. The release contained no significant surprises, although the decline in high-end consumer goods continues to be a thorn in the company’s side.

We will probably see a similar announcement from Lowe’s (LOW – Free report) in its upcoming publication on August 20thas the company also faced a decline in spending on large orders. Lowe’s expectations point to a slowdown, with both profits and revenue expected to be lower year-on-year.