Genscript Biotech (HKG:1548) H1 2024 Results

Key financial results

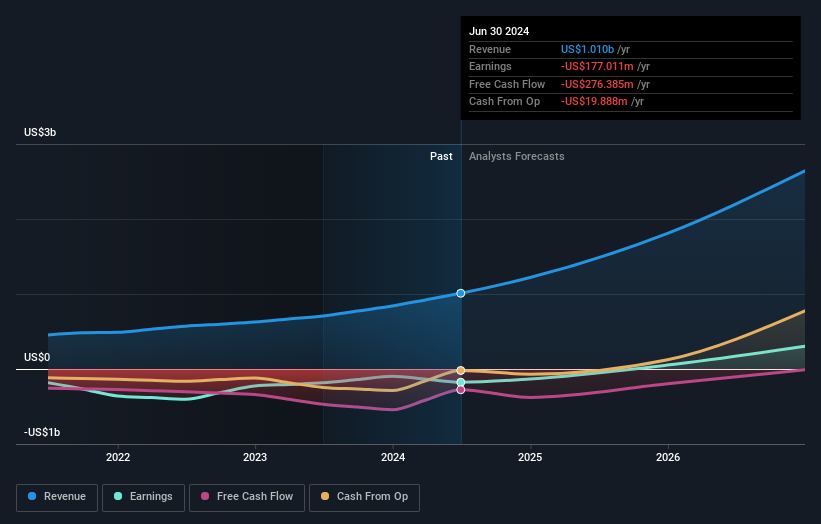

- Revenue: $561.4 million (up 44% from H1 2023).

- Net loss: $175.1 million (loss increased by 87% from H1 2023).

- Loss of $0.083 per share (a further deterioration from the loss of $0.044 in H1 2023).

All figures shown in the graph above refer to the last 12 months (TTM)

Genscript Biotech revenue exceeds expectations, EPS falls short of expectations

Sales exceeded analyst estimates by 2.5%. Earnings per share (EPS) fell short of analyst estimates.

Average sales growth of 39% per annum is expected for the next three years. In Asia, the growth forecast for the life sciences industry is 14%.

Development of the market in Hong Kong.

The company’s shares rose 2.2% compared to the previous week.

Risk analysis

Don’t forget that there can still be risks. For example, we have found 1 warning signal for Genscript Biotech that you should know.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.