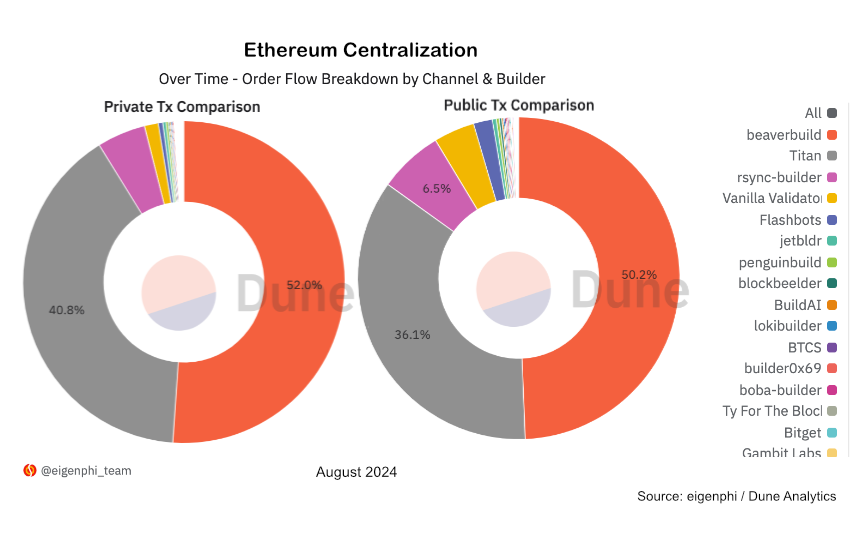

One of the many goals of the 2022 Ethereum merger was to make Ethereum more decentralized. From a validator perspective, things aren’t going badly. Statistics show that Coinbase is the largest, controlling almost 12% of staked ETH (although some claim it’s more like 30%). However, validators don’t create the contents of blocks. Blockbuilders are the ones who include transactions, decide their order, and then bid in the auction to include their block. This month, a single blockbuilder, Beaverbuild, created more than half of Ethereum’s blocks.

Over 85% of the blocks were built by the two largest developers, and over 90% by the three largest.

This drive toward centralization is driven by maximum extractable value (MEV), where the block creator reorders transactions to gain an advantage. This usually involves a combination of front-running transactions and arbitrage.

In the past, all pending Ethereum transactions were publicly visible and block builders selected transactions and created blocks. However, to prevent others from seeing transactions, high-frequency traders (and other bot operators) have direct relationships with block builders and send them their transactions privately. These transactions are only private in the pending state.

Recent research by Blocknative has shown that more than half of Ethereum gas fees are now paid by these private blocks and these blocks account for 30% of all blocks.

This centralization of the block formation function was predicted early last year in a paper published by the Special Mechanism Group (now part of Consensys). The group has proposed one of the possible solutions to address this challenge.

High-frequency traders drive centralization

They predicted that high-frequency traders (HFTs) want to take advantage of private transactions and that the potential profits mean the associated block builder can outbid other block builders. In particular, HFTs tend to arbitrage between prices on centralized exchanges (CEXs) like Binance and decentralized exchanges (DEXs) like Uniswap. HFTs want to ensure that their transactions are at the top of the block, for which they are willing to pay generously.

Beaverbuild has been identified as one of the HFTs and EigenPhi claims that Symbolic Capital Partners is the HFT associated with Beaverbuild.

Any other player who wants to make sure their transactions are in the winning block will probably go straight to Beaverbuild. After all, they make up more than half of the winning blocks. Otherwise, they would go to number two, Titan. Since the proposed solutions are still in the research phase, the real question is: what can be done soon?