AppLovin (APP) is a Zack Rank #1 (Strong Buy) that specializes in mobile advertising, app monetization, and app discovery. It offers a suite of tools and services for mobile app developers to help them promote, monetize, and optimize their apps.

The stock has attracted interest from AI investors this year thanks to its AI-powered software platform AXON, but many are concerned that the company will not be able to sustain the 20% revenue growth it has seen in software platforms.

Although investors have every reason to be skeptical, the latest earnings report and the subsequent share price development give rise to great optimism for AppLovin.

About the company

Founded in 2011, AppLovin has a market capitalization of $25 billion and employs over 1,700 people.

The company operates in two segments: Software Platform and Apps. Key software solutions include AppDiscovery to match advertiser demand with publisher supply, MAX to optimize ad inventory value through real-time auctions, adjust for marketing analytics, and Wurl to distribute streaming video and provide advertising solutions. Other offerings include SparkLabs for app store optimization, AppLovin Exchange to connect buyers with mobile and CTV devices, and Array for app management.

The company also operates various free mobile games.

The stock has a Zacks Style Score of “A” in Growth and Momentum. It has a Style Score of “D” in Value, with a Forward P/E ratio of 22.

Q2 results

On August 7, AppLovin reported earnings per share of 15% and revenues were in line. Second quarter earnings were $0.89, beating estimates of $0.77, while revenues were $1.08 billion. Second quarter adjusted EBITDA was $601 million, up 80% year over year, with a margin of 56%.

The company provided guidance for the third quarter, expecting revenue between $1.12 billion and $1.14 billion, above the estimate of $1.09 billion. Adjusted EBITDA for the third quarter is estimated at $630-650 million, with a margin of 57%.

Monthly active payers (MAPS) fell to 1.6 million from 1.7 million a year ago. The company also repurchased 4.2 million shares for $356 million and has $500 million remaining under its repurchase authorization.

After the figures were published, the stock was trading over 10% lower after hours. However, there were buyers and the stock was able to quickly make up its losses. The next day, the upward trend continued and the stock was up by as much as 14%.

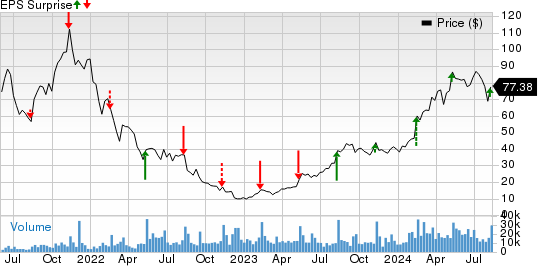

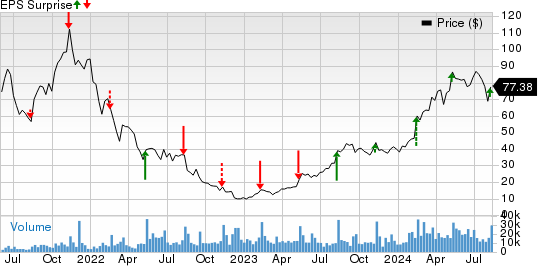

Price and EPS surprise at AppLovin Corporation

AppLovin Corporation Price EPS Surprise | AppLovin Corporation Quote

Estimates are rising

Since the results were released, analysts have significantly raised their estimates for AppLovin.

Over the past seven days, estimates for the current quarter have increased by 19%, from $0.75 to $0.89. For the current year, estimates have increased from $3.06 to $3.48, representing a 14% increase over the same period. A similar trend can be seen for next year, where estimates have increased by over 17%, from $3.57 to $4.18.

In addition, several companies have adjusted their price targets, with some raising or maintaining their targets above $100:

-

Oppenheimer reiterated its “outperform” rating and raised its price target from $97 to $105.

-

Jefferies maintained its price target at $105.

Overall, the trend toward higher price targets reflects the increased optimism of analysts. The consensus is that the stock is undervalued in its core gaming advertising business and has significant potential to increase share price gains through eCommerce.

The technical view

The stock is set to rise nearly 100% in 2024, so some investors are apprehensive about pursuing this name. While this is understandable, the stock is in a bullish situation.

The recent sharp sell-off in global equity markets dragged APP down. However, this allowed investors to buy the stock at the 200-day moving average. After the earnings release, this level was retested and the stock rebounded strongly.

With the moving average support, the $58 level was also the 61.8% Fibonacci retracement for 2024. It is clear that this level is important for the bulls, and with a bounce to the 21-day MA at $77, the stock is now attempting to break the support.

A major downside is that the 21-day MA is below the 50-day MA at $80. However, if the bulls can break this resistance, the 2024 highs are likely in play. Additionally, there are Fibonacci levels above $100 that would make excellent targets for the bulls.

In summary

AppLovin’s strategic positioning in mobile advertising, supported by the AI-powered AXON platform, has generated significant interest in the investor community.

The sharp rise in analyst estimates and the confirmation of positive price targets show that the market is optimistic about AppLovin’s future. As the company continues to capitalize on its unique offerings, it seems poised for further success in the emerging mobile and app development industry.

As overall market conditions stabilize, AppLovin’s mix of growth, innovation and strategic execution could continue to drive the share price higher and reward those who position themselves early.

Want the latest recommendations from Zacks Investment Research? Download the 7 best stocks for the next 30 days today. Click here to get this free report

AppLovin Corporation (APP): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research