Robert Half Inc. ((RHI – Free report) ) is a global staffing and consulting firm specializing in professional services. Founded in 1948, Robert Half is headquartered in Menlo Park, California. The company operates through several business units, including Accountemps, OfficeTeam, Robert Half Technology, Robert Half Finance & Accounting, and Protiviti, its consulting arm. The company provides temporary, full-time, and project-based staffing solutions in areas such as accounting, finance, technology, legal, and administrative support.

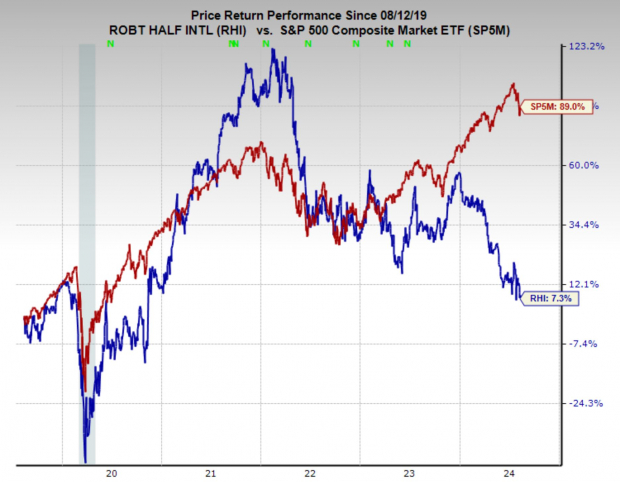

Although Robert Half is one of the leading companies in the staffing industry, its business has been stagnant over the past five years. During this period, revenue, profit and share price have stagnated. In addition, Robert Half trades at a premium to its historical valuation and has a Zacks Rank 5 (Strong Sell) Evaluation.

Because of these factors, investors should avoid Robert Half Inc. stock until the company can reverse its flagging growth rate.

Image source: Zacks Investment Research

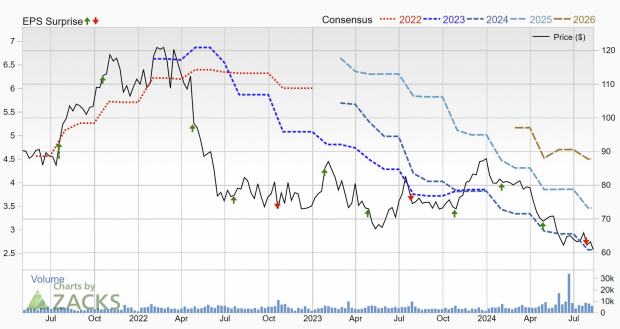

Analysts lower estimates for Robert Half Inc.

Robert Half operates in a highly competitive market and faces tough competition on price and reliability of services at national, regional and local levels. Earnings forecasts have been trending downward for more than two years, dragging the stock down with them. These downgrades give RHI a Zacks Rank 5 (Strong Sell)which suggests that there could be further downward moves in the future.

Sales are expected to fall 8.8 percent this year and profits are expected to fall 33.5 percent over the same period. Over the next three to five years, profits are expected to grow by just 4.1 percent annually.

Image source: Zacks Investment Research

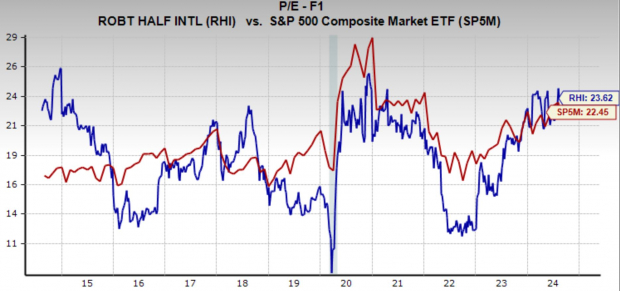

RHI is trading at a premium at the start. Room for manoeuvre to the downside

Despite Robert Half’s uncertain business outlook, the stock still trades at a premium. At 23.6 times forward earnings, it is above the market average and above the 10-year median of 18.7.

In addition, with EPS growth forecast at just 4.1% annually, shares are trading at a PEG ratio of 5.73, which is extremely high for this metric.

Image source: Zacks Investment Research

Should investors buy Robert Half Inc. shares?

Given the current challenges facing Robert Half Inc., investors should be cautious before considering this stock. The company has struggled with stagnation in both revenue and earnings over the past five years, and its recent performance has been disappointing. With a Zacks Rank of 5 (Strong Sell) and analysts consistently revising their earnings estimates downward, the near-term outlook for the stock appears bleak.

While Robert Half remains a significant player in the staffing industry, its recent troubles and high valuation make it a risky investment at this time. Investors may want to wait for clearer signs of a turnaround before adding RHI to their portfolio.