Shareholders may have noticed that Hoshizaki Corporation (TSE:6465) reported its interim results this time last week. Initial reaction was not positive, with shares falling 2.5% last week to close at JP¥4,277. It was a passable result, with revenue of JP¥218 billion, 4.3% ahead of expectations, and statutory earnings per share of JP¥227, in line with analysts’ estimates. Earnings numbers are an important time for investors as they can track a company’s performance, look at what analysts are forecasting for next year, and see if sentiment toward the company has changed. Readers will be pleased to know that we’ve rounded up the latest statutory forecasts to see if analysts have changed their minds about Hoshizaki following the latest results.

Check out our latest analysis for Hoshizaki

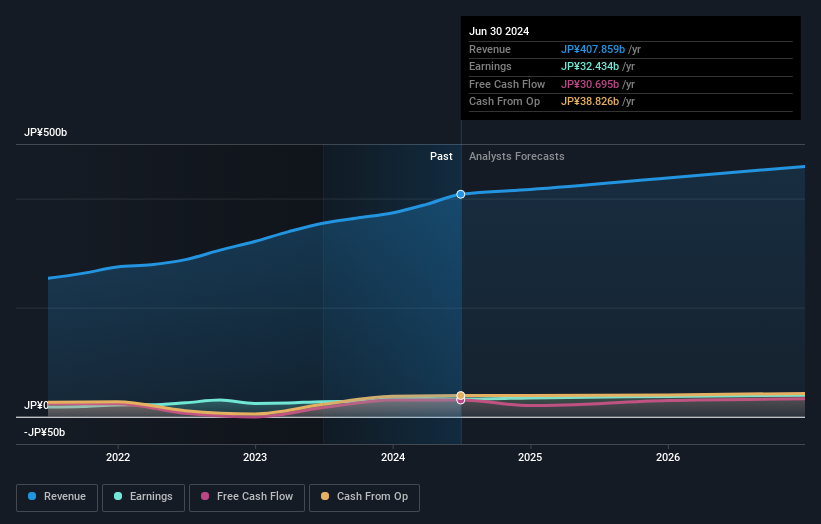

Taking the latest results into account, the consensus forecast from Hoshizaki’s eight analysts is for revenues of JP¥416.5 billion in 2024. This represents a credible 2.1% increase in sales compared to the last 12 months. Earnings per share are expected to increase by 6.6% to JP¥242. However, prior to the release of the latest results, analysts had been expecting revenues of JP¥416.4 billion and earnings per share (EPS) of JP¥238 in 2024. The consensus analysts do not seem to have seen anything in these results that would have changed their view of the company, as their estimates have not changed significantly.

There were no changes to revenue or earnings estimates or the price target of JP¥6,204, suggesting that the company met expectations with its latest result. However, that’s not the only conclusion we can draw from this data as some investors also like to consider the range of estimates when evaluating analyst price targets. Currently, the most optimistic analyst values Hoshizaki at JP¥7,000 per share, while the most pessimistic analyst values it at JP¥5,500. The narrow range of estimates could suggest that the company’s future is relatively easy to value, or that analysts have strong opinions on its prospects.

Of course, one can also look at these forecasts in the context of the industry itself. We would like to highlight that Hoshizaki’s revenue growth is expected to slow down. The forecast annual growth rate of 4.3% until the end of 2024 is well below the historical growth of 8.4% per annum over the past five years. Compare this to the other companies in the industry covered by analysts, whose revenues (in total) are expected to grow at a rate of 4.8% annually. So it’s pretty clear that while Hoshizaki’s revenue growth is expected to slow down, it is expected to grow roughly in line with the industry.

The conclusion

Most importantly, there were no major sentiment swings. Analysts confirmed that the company is performing in line with their previous earnings per share estimates. Fortunately, there were no real changes in revenue forecasts. The company is still expected to grow in line with the wider industry. The consensus price target remained stable at JP¥6,204, with recent estimates not enough to have an impact on price targets.

However, the long-term trajectory of the company’s earnings is much more important than the next year. We have estimates from several Hoshizaki analysts going out to 2026. You can see them here for free on our platform.

You can also see our analysis of Hoshizaki’s board and CEO compensation and experience, and find out if any company insiders have been purchasing shares.

Valuation is complex, but we are here to simplify it.

Find out if Hoshizaki could be undervalued or overvalued with our detailed analysis, including Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.