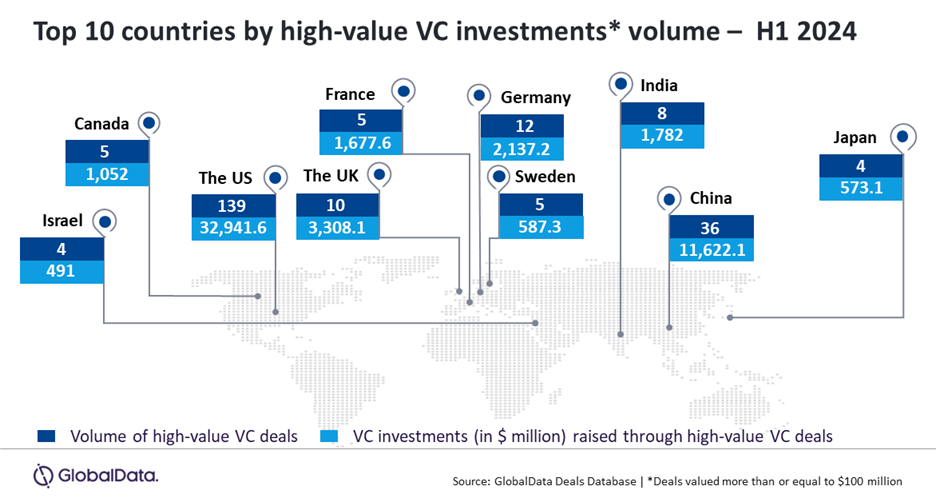

The US was home to the majority of high-profile venture capital (VC) investments globally in the first half of 2024, accounting for 54.7% and 55% of deal volume and value, respectively. This trend reflects the country’s strong innovation ecosystem in shaping the competitive investment landscape, reveals GlobalData, publisher of RBI.

An analysis of GlobalData’s deals database found that the US is followed by China by a wide margin, and that these two countries together account for more than two-thirds of the total volume and value of high-profile VC investments.

Aurojyoti Bose, senior analyst at GlobalData, comments: “The US continues to dominate, outperforming peer countries by a wide margin in terms of volume and value of high-profile VC deals, while China also continues to be a significant market for VC funding activity. The importance of the US and China is demonstrated by the fact that these are only two markets with double-digit market shares.”

The US and China together accounted for 68.9% of the total number of high-value VC investments announced globally in the first half of 2024, while their share of the corresponding funding value was 74.3%.

In the US, 139 high-profile VC deals valued at $32.9 billion were announced in the first half of 2024.

Meanwhile, a total of 36 high-profile VC deals worth USD 11.6 billion were announced in China during the reporting period, accounting for 14.2 percent and 19.4 percent of the transaction volume and value, respectively.

Bose adds: “Of the ten countries with the highest volume of VC deals in the first half of 2024, four are in Europe, three in Asia Pacific, two in North America and one in the Middle East and Africa.

Access the most comprehensive company profiles on the market, powered by GlobalData. Save hours of research. Gain a competitive advantage.

Company profile – free sample

Thank you very much!

Your download email will arrive shortly

We are confident in the unique quality of our company profiles, but we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by filling out the form below.

By GlobalData

The USA and China were followed by Germany, Great Britain, India, France, Canada, Sweden, Japan and Israel.

Bose concludes: “The data underscores the clear dominance of the US and its attraction for innovation. China remains a formidable player, and together these two countries have an impressive share of the global VC landscape. The diverse global presence of other top countries underscores a competitive yet US-centric venture capital market that reflects both the opportunities and challenges facing emerging markets seeking a larger share.”