Data centers are the new darling of investors in the first half of 2024, accounting for 14 percent of acquisition and disposal deals during that period, according to DLA Piper’s half-year report on real estate investment trends.

While this is not the largest share of deals during this period—that distinction still goes to multifamily properties, followed by industrial real estate—data center share saw the strongest growth from 2023, when it accounted for just 4 percent, and from the two years prior to that, when there were no deals at all in this sector.

This result is in line with a survey conducted by DLA Piper earlier this year, which found that data centers are the most attractive asset class, up more than 20 percentage points from the previous year.

In addition, this spring’s report said that data centers were a growth area. DLA Piper now says that this is clearly showing in practice: the company’s data center team is handling an increasing number of data center acquisitions and financings.

For the new report, DLA Piper examined over 850 purchase and disposal agreements as well as over 400 property management agreements.

READ ALSO: More data centers, please!

Buying and selling weren’t the only elevated metrics for data centers in the first half of 2024, the report said. The percentage of data center (and industrial) properties where the project’s construction cost was 5 percent or more increased. About 60 percent of those deals had a charge of 5 percent or more, while 40 percent were in the 3 to 4 percent range.

Further findings

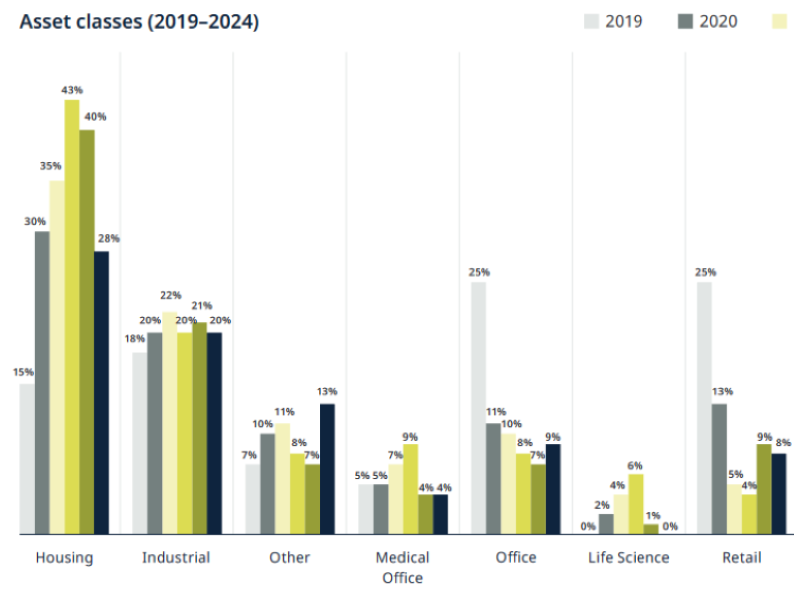

The report found that office transactions, still well below pre-pandemic levels, actually increased slightly in the first half of 2024, standing at 9 percent, compared to 7 percent in 2023. In 2019, offices accounted for a full quarter (25 percent) of purchases and sales, according to the DLA Piper report.

Retail, which also accounted for 25 percent of acquisitions and divestments in 2019 but fell sharply in 2020, saw a slight decline from 9 percent to 8 percent between 2023 and 2024. The industrial sector has been fairly consistent in terms of acquisitions and divestments in recent years, DLA Piper explained: 20 percent in 2024, the same as in 2022 and 2020, and just a little less than the 21 percent in 2023.

Another trend highlighted in the report was longer representation and warranty periods in commercial real estate transactions.

A survival period is the period within which claims for breaches of representations and warranties can be made. According to the report, 45 percent of transactions have a survival period of 270 days and 21 percent have a survival period of 365 days or more. Shorter survival periods, particularly those of 180 days, continue to decline, with their frequency falling from 33 percent to 29 percent.