Even if a company is losing money, shareholders can make money if they buy a good company at the right price. Software-as-a-service company Salesforce.com, for example, has been losing money for years while growing its recurring revenue. However, anyone who held its stock since 2005 would have done very well. The harsh reality, however, is that a great many loss-making companies burn through all their cash and go bankrupt.

The natural question for Tilly’s (NYSE:TLYS) shareholders should be concerned about its cash burn percentage. For this article, we define cash burn as the amount the company spends each year to fund its growth (also known as negative free cash flow). First, we determine its cash runway by comparing its cash burn to its cash reserves.

Check out our latest analysis for Tilly’s

When might Tilly’s run out of money?

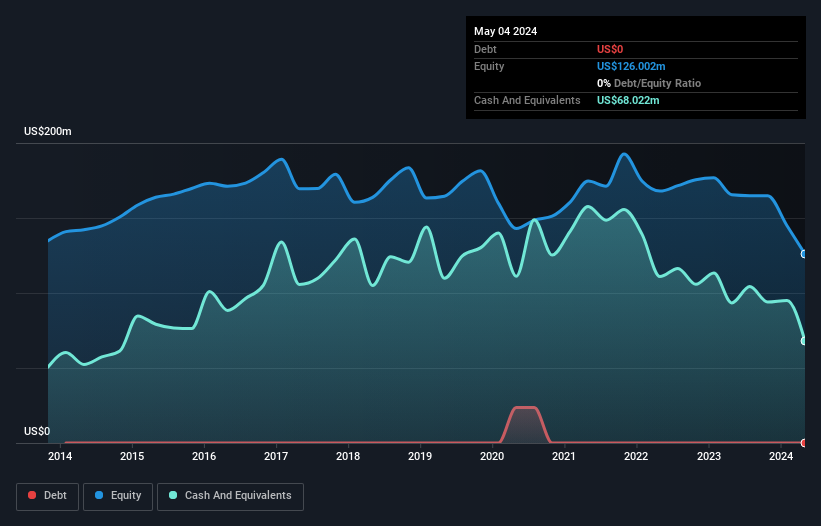

You can calculate a company’s cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As of May 2024, Tilly’s had cash of $68 million and no debt. Over the last year, its cash burn was $28 million. So, as of May 2024, the company had a cash runway of about 2.4 years. This is arguably a prudent and reasonable runway length. You can see how cash holdings have changed over time in the chart below.

How well does Tilly’s grow?

Tilly has increased its capital expenditures significantly over the last year, with cash burn rising 69%. That alone is worrying, but the fact that operating income actually fell 5.4% over the same period is what really makes us nervous. Taken together, we think these growth numbers are a little concerning. While it’s always worth studying the past, what matters most is the future. For this reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Tilly’s easily raise more money?

While Tilly’s appears to be in a pretty good position, it’s still worth considering how easily the company could raise more cash, even if it just grew faster. Generally speaking, a publicly traded company can raise new money by issuing shares or taking on debt. Typically, a company sells new shares to raise cash and fuel growth. By comparing a company’s annual cash burn to its total market capitalization, we can roughly estimate how many shares it would need to issue to keep the company running for another year (assuming the same burn rate).

With a market cap of $155 million, Tilly’s $28 million cash buy represents about 18 percent of its market value. Given this situation, it’s probably safe to assume the company would have little trouble raising more money for growth, but shareholders would be somewhat diluted.

So should we be worried about Tilly’s cash burn?

While we are a little concerned about the increasing cash burn, we must mention that we found Tilly’s cash runway to be relatively promising. Although we are the kind of investors who are always a little concerned about the risks associated with companies burning cash, the metrics we have discussed in this article make us relatively confident about Tilly’s situation. Readers need to have a solid understanding of business risks before investing in a stock, and we have found 2 warning signs for Tilly’s that potential shareholders should consider before investing money in a stock.

Naturally, If you look elsewhere, you may find a fantastic investment. So take a look at the free List of companies with significant insider holdings and this list of growth stocks (according to analyst forecasts)

Valuation is complex, but we are here to simplify it.

Find out if Tilly’s could be undervalued or overvalued with our detailed analysis, Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.