Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report with detailed historical actuals and estimates for the current and following periods by clicking here>>>

Here are the key points:

-

The second-quarter earnings season revealed an overall stable picture of corporate profitability, with management teams generally providing a reassuring view of the economic reality. However, question marks have emerged over the outlook, with estimates for the current period declining more than in the past two periods.

-

Of the 473 S&P 500 companies that reported second-quarter results (94.6% of all index members), total earnings increased 8.0% year-over-year, with revenues up 5.0%. 79.7% beat earnings per share estimates and 59.8% beat revenue estimates.

-

For the retail sector, we now have Q2 results from 96.2% of the sector’s market cap in the S&P 500 index. Total earnings for these companies increased 17.3% from the same period last year, with revenues up 4.8%. 62.1% beat EPS estimates and 44.8% beat revenue estimates.

-

This is a weaker performance compared to what we’ve seen from these retail companies in more recent periods. Second-quarter earnings growth turns negative when Amazon’s results are stripped out of the sector numbers. The second-quarter earnings per share and revenue percentage beats for this group of retail companies represent a new low in the trailing 20-quarter period.

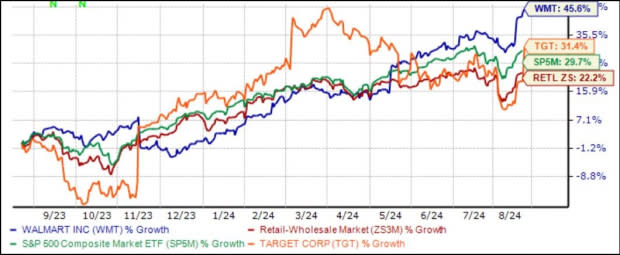

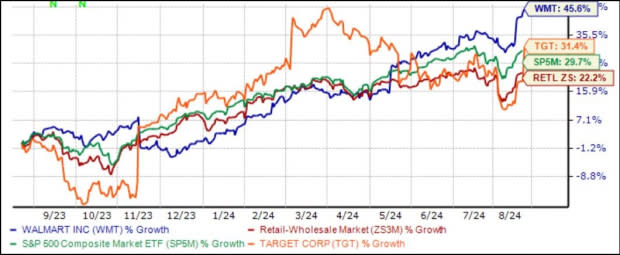

The focus of earnings in recent days has been on the retail sector, with Target TGT comfortably beating expectations on comparable-store sales (comps), earnings, and positive earnings guidance. Target shares rallied sharply after several quarters of declines on the resumption of positive comps, with demand for a number of nonessential goods performing favorably. This confirmed the positive trends we saw in the nonessential categories in Walmart’s WMT quarterly earnings report on expectations and uplift a few days ago.

Target shares have lagged Walmart by a wide margin, reflecting the company’s strong focus on nonessential goods. Walmart, on the other hand, has benefited from its strong focus on groceries and other everyday goods.

The chart below shows Target stock performance compared to Walmart, the Zacks Retail sector and the S&P 500 index over the past year.

Image source: Zacks Investment Research

We discussed the earnings summary for the retail sector and how the second quarter results compare to other recent periods in Section 1 of this report.

The overall picture of earnings

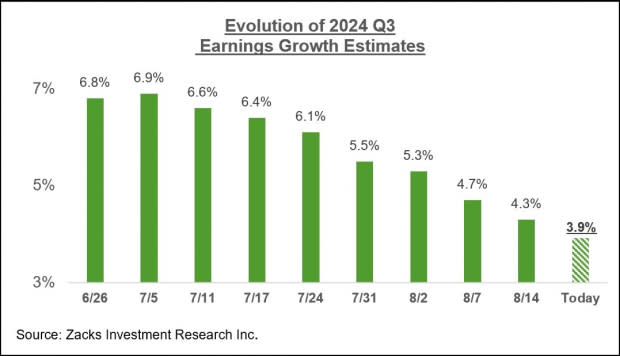

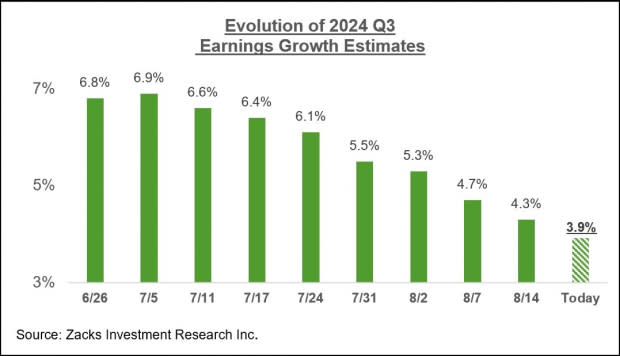

For the current period (Q3 2024), the S&P 500 is expected to report a total gain of +3.9% compared to the same period last year, with sales up +4.6%. As the chart below shows, estimates have fallen since the beginning of the quarter.

Image source: Zacks Investment Research

This is a larger decrease in estimates compared to the comparable periods of the previous two quarters. The trend of negative revisions is widespread and not concentrated in one or two sectors. Estimates for 14 of the 16 Zacks sectors were cut during this period. The Technology and Financials sectors are the only ones to see positive estimate revisions during this period.

The following graph shows the overall earnings situation on a quarterly basis.

Image source: Zacks Investment Research

The following graph shows the overall earnings situation on an annual basis.

Image source: Zacks Investment Research

Please note that this year’s earnings growth of +8.0% with only +1.8% revenue growth reflects revenue weakness in the financial sector. Excluding the financial sector, the earnings growth pace changes to +7.5% and the revenue growth rate improves to +4.2%. In other words, about half of this year’s earnings growth is due to revenue growth, with the rest coming from margin expansion.

In terms of margins, 11 of the 16 Zacks sectors are expected to have higher year-over-year margins in 2024, with technology, financials and consumer discretionary sectors being the biggest winners.

Want the latest recommendations from Zacks Investment Research? Download the 7 best stocks for the next 30 days today. Click here to get this free report

Target Corporation (TGT): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research