After a brief decline earlier this month, the S&P 500 is approaching its all-time high again. This recovery signals strong investor confidence in stocks and suggests that the upward momentum is far from over.

The only question is: Which stocks are ready to ride this upward wave?

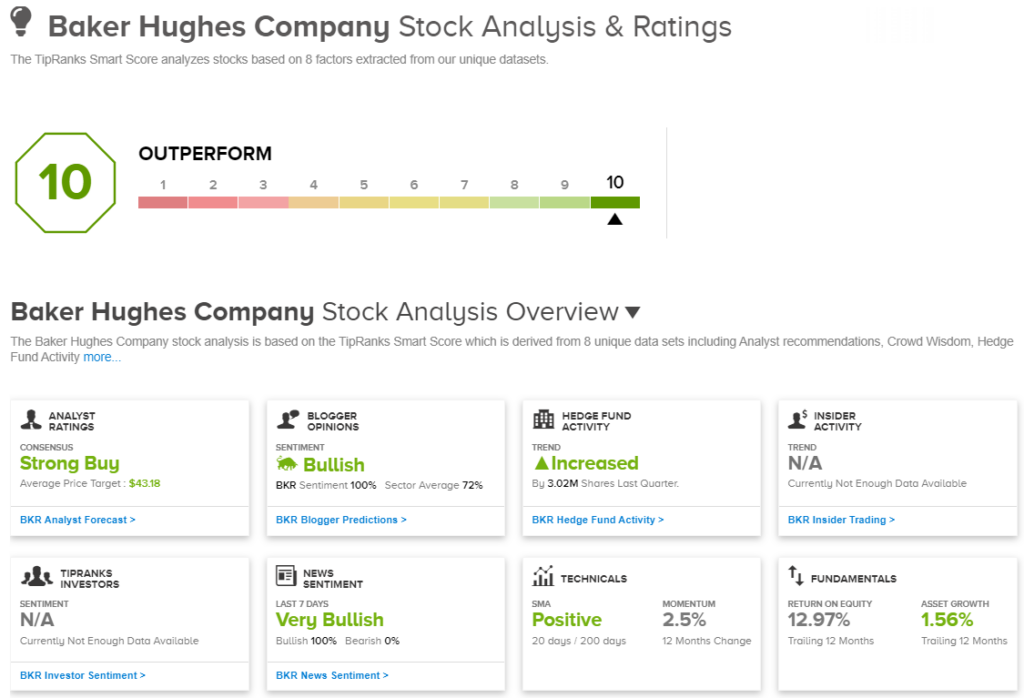

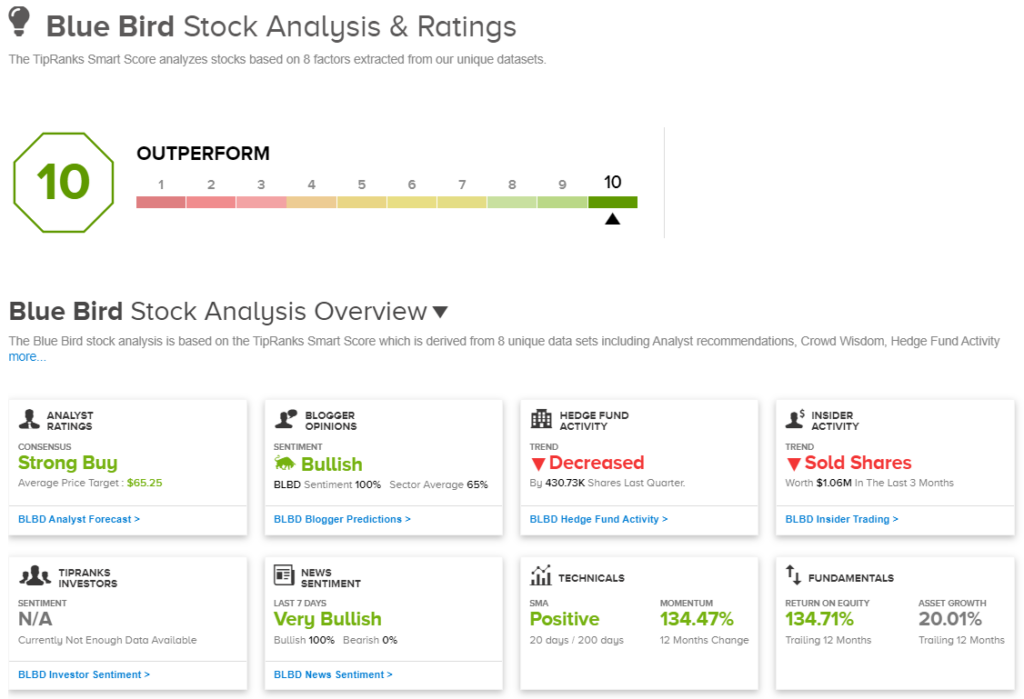

This is where investors can turn to Smart Score. This sophisticated data tool, powered by AI and machine learning algorithms, collects and organizes aggregate data from the stock markets and uses it to compare each stock against a set of factors known to correlate with future outperformance. The end result is a single score for each stock on an intuitive scale of 1 to 10, with the “Perfect 10” being the highest – indicating stocks that deserve special attention.

The Smart Score helps investors see at a glance where a stock’s biggest opportunity might lie. We can track these indicators and use the Smart Score as a guide to find high-quality stocks with solid prospects. Using the TipRanks database, we’ve started doing this – and found two “Perfect 10” names that analysts see as solid opportunities. Here are the details on two of those top-scoring stocks.

Baker Hughes Company (BKR)

We start with the oil industry, where Baker Hughes has long been a leading provider of oilfield services. Baker Hughes is an advanced industrial technology company that works to both develop and deliver the energy technology needed to maximize production and efficiency in the world’s hydrocarbon producing regions. Baker Hughes partners with oil and natural gas producers and industrial companies to provide optimized solutions for developing clean and reliable energy. The company is recognized for its leadership and solutions in the liquefied natural gas industry.

Energy is needed worldwide and Baker Hughes is a global company. The company operates in over 120 countries and employs over 58,000 people. In a major announcement last May, the company announced its new contract with SONATRACH to support natural gas production in Algeria. The project is an important aspect of the energy supply chain for Europe and especially for Italy.

Looking at Baker Hughes’ financial results, we find another set of solid data supporting the stock. Baker Hughes reported revenue of $7.1 billion for the second quarter of 2024, up nearly 13% year over year and beating forecast by about $300 million. The company’s earnings on non-GAAP measures were 57 cents per share, a figure that was 8 cents per share better than expected. The company’s second quarter results also included $7.5 billion in new orders, including $3.5 billion in IET orders.

Yield-seeking investors should know that Baker Hughes has a long history of making regular dividend payments. The payment history stretches back to 1989. The last quarterly dividend was paid on August 16 at 21 cents per share. On an annualized basis, this equates to 84 cents and gives a yield of 2.4%. In the second quarter of this year, Baker Hughes paid a total of $209 million in dividends and supported this yield with share buybacks valued at $166 million.

Overall, this picture has caught the attention of Evercore analyst James West. West is particularly impressed with this company’s ability to leverage its expertise in specific energy niches, as well as its strong execution and regular cash returns.

“Baker continues to improve and optimize its performance by capitalizing on opportunities in OFSE, LNG, new energy and emerging IET areas. The company’s strategy is clearly defined and focused on four key objectives: 1) commercial execution in a strong energy cycle, 2) leveraging the new organizational structure for improved performance and earnings, 3) developing the new energy portfolio and 4) generating strong free cash flow and returning cash to shareholders… We continue to rate the shares as outperform,” West said.

This Outperform (i.e. Buy) rating is backed by a $46 price target, implying a one-year upside potential of ~31%. (To follow West’s track record, click here)

Overall, BKR shares have received a consensus rating of Strong Buy from Wall Street analysts based on 17 recent reviews, including 15 buy recommendations and 2 hold recommendations. The stock is priced at $35.16 and their average price target of $43.18 suggests BKR will gain ~23% or more in the coming months. (See BKR stock analysis)

Blue Bird (BLBD)

The next company we’ll look at is Blue Bird Corporation, a company you’ve probably never heard of – although you’ve probably used their main product too. This Georgia-based industrial company has been in business for more than 90 years, building a variety of specialty vehicles: buses, RVs, mobile libraries, and mobile police command centers. From the beginning, however, Blue Bird has been closely associated with the design, manufacture, and distribution of school buses, and is one of the largest players in this niche.

Blue Bird employs approximately 1,500 people and has a network of dealers and distributors throughout North America. The company operates globally and its products are available in 60 countries worldwide. Blue Bird’s corporate mission is to design, build and distribute the best school buses in the world.

On the financial side, Blue Bird reported revenue of $333.4 million in its latest quarterly results for the third quarter of 2024, up nearly 13% year over year and beating estimates by $6.72 million. Revenue supported non-GAAP earnings of 91 cents per share, an impressive 40 cents per share above forecasts.

Blue Bird’s shares reflect this earnings power, with the stock up 78% year-to-date and 120% over the past 12 months.

Analyst Chris Pierce, who covers this stock for Needham, sees good prospects for further growth, writing about the company and its shares: “BLBD is on track for high double-digit year-over-year revenue growth on 5% unit growth, benefiting from pricing actions on conventional fuel school buses and a roughly three-fold ASP premium on subsidized ESBs. BLBD’s guidance calls for adjusted EBITDA margin leverage of approximately 600 basis points, driven by gross margin acceleration from pricing increases and ESB mix benefits. We expect momentum to continue on both fronts as the school bus industry is in the early stages of a cyclical recovery and ESB allocations and final deliveries to customers are well underway.”

These comments support a Buy rating on the stock, and Pierce adds a $72 price target, expressing confidence in a 50% upside potential for the next 12 months. (To watch Pierce’s track record, click here)

Overall, Blue Bird’s consensus recommendation is unanimous as a Strong Buy, based on 5 positive analyst reviews over the past few weeks. The stock is currently trading at $47.87 and its average price target of $65.25 suggests it will gain 36% in value in the coming year. (See BLBD stock analysis)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unifies all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important that you conduct your own analysis before investing.