On July 31, Governor Maura Healey signed a Pay Range Transparency Act (H.4890) to increase pay equity and transparency by requiring employers to disclose pay ranges and protecting workers’ rights to ask about pay ranges.

The legislation is nothing more than window dressing that does little to address the rampant problem of pay inequality in the Commonwealth.

The governor wants the public to believe that the new law will help promote equity in the workplace, especially for workers who have historically been marginalized.

“I have long supported equal pay legislation and as Attorney General, I was proud to work with the business community to implement the Equal Pay Act of 2016,” said Governor Maura Healey. “This new law is an important next step in closing the pay gap, especially for people of color and women. It will also strengthen the ability of Massachusetts employers to build diverse, talented teams. I want to thank lawmakers, stakeholders, unions and the business community for their hard work in getting this law passed.”

The law requires public and private employers with 25 or more employees to disclose salary ranges in job postings, to inform employees who are offered a promotion or transfer of a position’s salary range, and to inform employees who already hold that position or are applying for it of the salary range upon request. The Attorney General’s Office will conduct a public education campaign on these new rules.

This is somewhat good news if you are an employee working at or applying for a job at an educational institution, a large banking chain, a technology company, or any other company that employs a gentleman employee.

Yet, the salary range is disclosed to employees upon request. Are these legislators completely unaware of the power imbalance between workers and managers that almost inevitably results in consequences for the employee who confronts their manager and demands this information?

But here is the big problem:

According to the 2021 Small Business Profile from the U.S. Small Business Administration’s Office of Advocacy, a whopping 99.5 percent of all employers in Massachusetts are small businesses.

Let that sink in – 99.5 percent.

Granted, a small business is one with fewer than 500 employees, and you might think that means that roughly 95 percent of workers would enjoy the protections that this new transparency brings. Unfortunately, you have to look at the industries where workers are most vulnerable to wage secrecy and pay disparity.

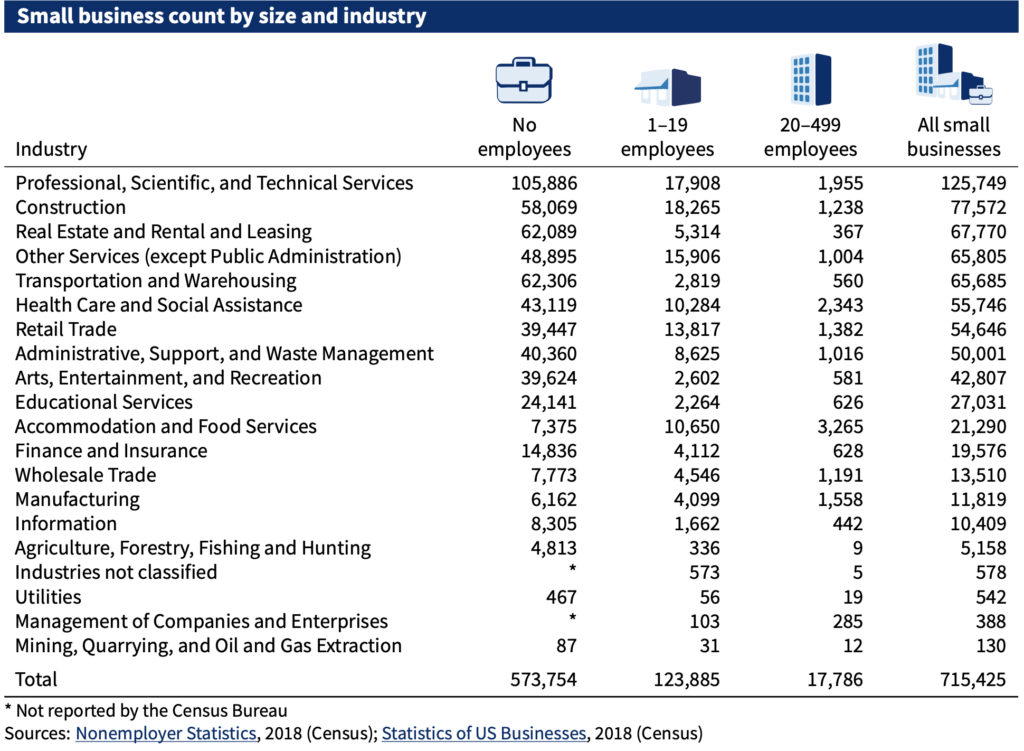

First, however, one must ask why the drafters of the bill chose a threshold of 25 or more employees. Virtually every yardstick distinguishes between small businesses with fewer than 10, fewer than 20, fewer than 100, and fewer than 500 employees. At least, that is how the U.S. Census and the U.S. Department of Labor recognize the differences. Creating an exception for a group of businesses with five more employees than the standard “under 20 employees” classification not only excludes tens of thousands of workers from the scope of protection, but also makes it extremely difficult to quantify the impact on workers.

The “hard work” for which the governor thanked the business community undoubtedly included intense lobbying for a measure that would obscure the actual insignificance of the legislation for hundreds of thousands of workers.

Healey and all the lawmakers and advocates who applaud the bill’s passage claim that women and people of color will be the beneficiaries of this new wage equity. Let’s look at some of the fields that employ so many oppressed people.

In 2021, 10,650 companies in the accommodation and food services category employed fewer than 20 people, compared to only 3,265 companies with 20 to 499 employees.

The number of companies in the “Health and Social Assistance” sector with fewer than 20 employees was 10,284, compared to 2,343 companies with up to 499 employees.

In the retail sector, there were ten times as many, with 13,817 companies with fewer than 20 employees, compared to 1,382 companies with up to 499 employees.

These industries employ a disproportionate number of women and people of color, who often have little or no higher education that would lead to more lucrative careers.

According to the American Community Survey, 2018, the Annual Business Survey, 2018 (Census), and Nonemployer Statistics by Demographics, 2017 (Census), women made up 49.2 percent of small business employees, while racial minorities made up 19.6 percent.

Although construction is a male-dominated sector, it is also predominantly run by people of color. And yes, there are some very large companies to name, but the companies with fewer than 20 employees far outnumber the 1,238 companies with 20 to 499 employees, at 18,265 – a difference of more than 14.75 times.

Adding those five workers to the category of “workers under 20” to make it “workers under 25” skyrockets the number of workers and applicants not covered by the new wage transparency law. This turns this absurd legislative deception into a farce, an ungodly attack on women and people of color who make up the suffering masses of Massachusetts’ working poor – the exact opposite of its stated goals.

Sure, according to a report from the Executive Office of Labor and Workforce Development released last week, Massachusetts’ current employment figure is 3,750,200. Workers will benefit from the new law, but which workers? And in what occupations?

With the exception of the category of “professional, scientific and technical services” (which also employs a significant number of women and people of color), the sectors that benefit from the exploitation of marginalized groups consist of companies with “employees under the age of 20,” a proportion that dwarfs that of large companies.

Well over half a million workers, mostly blue collar workers, clock in every day at these tiny little businesses in Massachusetts. That the General Assembly and the Governor would engage in such deception in the name of business is a reprehensible insult to the hundreds of thousands already hurt by an unjust economy.