Global investors are focusing on China’s faltering economy even as they consider the possibility of a recession in the U.S. as the Federal Reserve plans to cut interest rates. For commodities such as steel, Baowu’s warning underscores risks to demand and prices, as well as what ArcelorMittal SA, the industry’s No. 2, called an “aggressive” increase in exports from China.

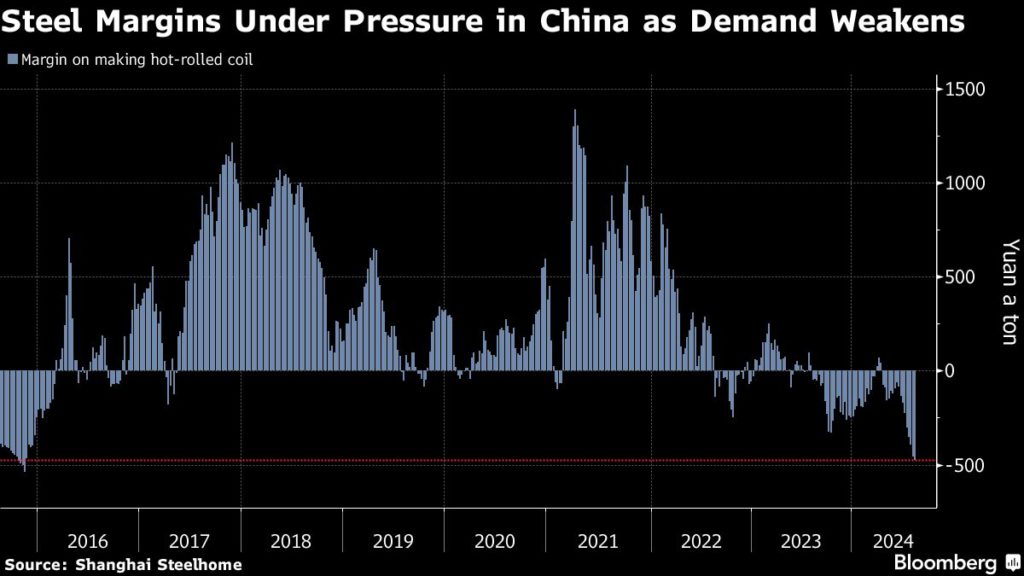

There are plenty of warning signs in China’s steel market – by far the world’s largest – as the ongoing property downturn shows no end in sight and factory activity remains subdued. Baowu alone produces about 7% of the world’s steel and its comments are closely watched to gauge market sentiment in the Asian country.

Hu’s forceful message is likely to worry competitors in Asia, Europe and North America, which are grappling with a new wave of Chinese exports, often by pushing for trade measures. Shipments from China are expected to reach about 100 million tonnes this year, the highest since 2016, as producers there try to offset a domestic decline.

German steel giant ThyssenKrupp AG highlighted the challenges facing the industry on Wednesday by reporting a sharp drop in profits. Earlier this month, ArcelorMittal said China’s rising exports had put the global market in an “unsustainable” position.

Iron ore futures in Singapore fell by as much as 3.4 percent to $95.20 per tonne, the lowest level since May last year. The collapse was even more pronounced on the steel markets: rebar futures in Shanghai plunged by more than 4 percent to their lowest level since 2017. BHP, which generates a large part of its revenue from selling iron ore to China, lost almost 3 percent.

The country’s steel industry suffered devastating declines during the global financial crisis of 2008-09 and again in 2015-16. In both cases, the crises were ultimately resolved by massive economic stimulus – a prospect that seems distant in 2024, when President Xi Jinping seeks to transform the economy.

Baowu did not elaborate on the causes of the current downturn and focused on how employees are responding: by preserving their cash and minimizing risks.

“Finance departments at all levels should pay more attention to the security of corporate financing,” Baowu said in a statement. Increased controls must be carried out, including for overdue payments and the detection of bogus transactions. “As we survive the long and harsh winter, cash is more important than profit.”

Column: Iron ore outlook dims due to falling inventories and steel production in China