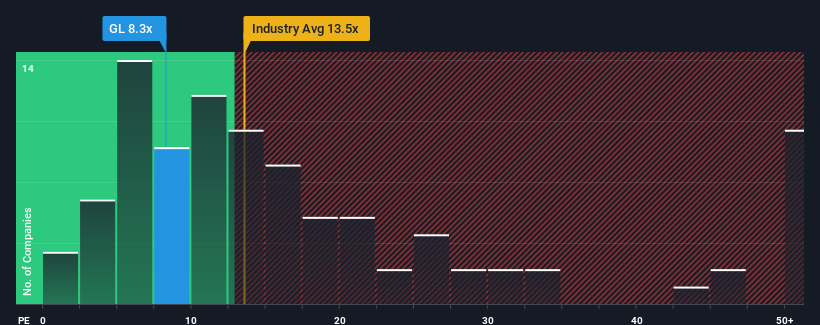

When nearly half of the companies in the United States have a price-to-earnings (P/E) ratio of over 18x, you may consider Globe Life Inc. (NYSE:GL) is a very attractive investment with its P/E ratio of 8.3. However, the P/E ratio might be quite low for a reason and further research is needed to determine if it is justified.

With earnings growth in positive territory compared to the declining earnings of most other companies, Globe Life has done quite well recently. One possibility is that the P/E ratio is low because investors believe the company’s earnings will soon collapse like everyone else’s. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Globe Life

Would you like to know how analysts assess the future of Globe Life compared to the industry? In this case, our free Report is a good starting point.

Does the growth match the low P/E ratio?

To justify its P/E ratio, Globe Life would have to show weak growth that significantly lags the market.

First, if we look back, we can see that the company managed to grow its earnings per share by an impressive 24% last year. The last three-year period also saw an excellent 57% increase in earnings per share, which was also due to short-term performance. So, first, we can confirm that the company has done a great job of growing its earnings during this period.

Looking ahead, the eight analysts who cover the company expect earnings to grow 11% annually over the next three years, roughly in line with the 10% annual growth forecast for the overall market.

Given this information, we find it strange that Globe Life is trading at a lower P/E than the market. Apparently, some shareholders doubt the forecasts and have accepted lower selling prices.

The last word

In general, we prefer to use the price-to-earnings ratio only when we want to determine what the market thinks about the overall health of a company.

Our study of Globe Life’s analyst forecasts found that the market-based earnings outlook is not contributing as much to the P/E as we would have expected. There could be some unseen earnings risks that are preventing the P/E from matching forecasts. At the very least, the risk of a price decline seems low, but investors seem to think that future earnings could be somewhat volatile.

And what about other risks? Every company has them, and we have 1 warning sign for Globe Life You should know about this.

Naturally, You may also be able to find a better stock than Globe Life. You may want to see this free Collection of other companies that have reasonable P/E ratios and strong earnings growth.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.