We can understand why investors are attracted to unprofitable companies. Software-as-a-service company Salesforce.com, for example, has been losing money for years while growing its recurring revenue. However, anyone who held shares since 2005 would have done very well. But while the successes are well known, investors should not ignore the many unprofitable companies that simply burn through all their cash and collapse.

This should also iTeos Therapeutics (NASDAQ:ITOS) Shareholders are concerned about cash burn? In this article, we define cash burn as annual (negative) free cash flow, which is the amount a company spends each year to finance its growth. Let’s start by looking at the company’s cash holdings relative to its cash burn.

Check out our latest analysis for iTeos Therapeutics

How long is iTeos Therapeutics’ cash runway?

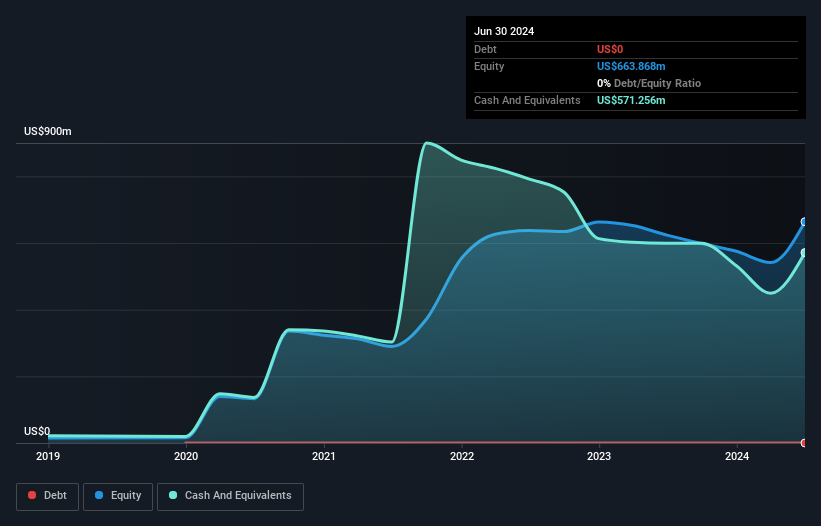

You can calculate a company’s cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In June 2024, iTeos Therapeutics had $571 million in cash and was debt-free. Over the last year, the company burned through $118 million. So it had a cash runway of about 4.9 years from June 2024. A runway of this length gives the company the time and space it needs to develop the business. You can see how cash levels have changed over time in the image below.

How well is iTeos Therapeutics growing?

Some investors may find it troubling that iTeos Therapeutics actually increasingly its cash burn, which has increased by 3.1% over the last year. Even more worrying is that operating income has fallen by 59% in that time. Taken together, we think these growth numbers are a little concerning. However, the key factor is clearly whether the company will grow its business in the future, so you should take a look at how much the company is expected to grow over the next few years.

How difficult would it be for iTeos Therapeutics to raise more money for growth?

iTeos Therapeutics appears to be in a pretty good position in terms of cash burn, but we still think it’s worth it considering how easily the company could raise more money if it wanted to. Companies can raise capital either through debt or equity. Many companies ultimately issue new shares to fund future growth. We can compare a company’s cash burn to its market capitalization to get a sense of how many new shares a company would need to issue to fund a year’s operations.

iTeos Therapeutics’ cash burn of $118 million represents about 22% of its $537 million market cap. That’s not insignificant, and at the current share price, if the company had to sell enough shares to fund another year of growth, it would likely incur some fairly costly dilution.

So should we be worried about iTeos Therapeutics’ cash burn?

While we are a little concerned about the declining revenue, we must mention that we found iTeos Therapeutics’ cash runway to be relatively promising. Companies that burn cash are always on the riskier side, but after considering all the factors discussed in this short article, we are not too concerned about the rate of cash burn. An in-depth study of the risks revealed 1 warning signal for iTeos Therapeutics what readers should think about before investing capital in this stock.

Naturally, If you look elsewhere, you may find a fantastic investment. So take a look at the free List of interesting companies and this list of growth stocks (according to analyst forecasts)

Valuation is complex, but we are here to simplify it.

Discover if iTeos Therapeutics could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.